The concepts and realities of the cryptocurrency ecosystem

In October 2008, an unknown person (or persons) using the name Satoshi Nakamoto introduced the world to the concept of Bitcoin by publishing a paper titled ‘Bitcoin: A peer-to-peer electronic cash system’.

The paper addressed problems related to conducting commercial transactions on the Internet, which have relied almost exclusively on financial institutions serving as trusted third parties to process electronic payments. Where digital coins are used, these trusted third parties can check every transaction to prevent double spending, which is when a fraudulent purchaser tries to use the same digital coin more than once. However, the entire coin system accordingly comes to depend on the third party.

An alternative is to develop an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with one another on a peer-to-peer basis, without need for a trusted third party. Nakamoto’s paper proposed the associated concepts of bitcoin and the blockchain as a way of achieving this alternative.

This article looks at both the theoretical and practical aspects of the cryptocurrency ecosystem, and discusses some of the caveats as well as the advantages of this young and volatile technology.

Fig.1: Bitcoin – Image via Flickr

How does cryptocurrency work?

Irrespective of this section’s title, it’s important to start any consideration of cryptocurrency with a realisation that from this article’s perspective, the concepts of cryptocurrency, bitcoin, and blockchain are inextricably linked. Bitcoin is just one example – albeit the first – of many types of cryptocurrency, of which thousands now exist. And bitcoin values are held in a blockchain database, and nowhere else.

However, there is another dimension beyond this article’s perspective, related to blockchain. This is an interesting and promising technology in its own right, and is starting to find applications in many areas unrelated to cryptocurrencies .

A maths blogger using the name 3Blue1Brown has produced a YouTube video that explains these concepts very well. He uses a ‘Back to Basics’ approach which describes how a group of people who wish to facilitate an easy way of recording ongoing transactions between themselves might develop a suitable protocol, starting with a simple ledger on a computer website. By discussing the problems they would encounter and how they could solve them, he builds the protocol into the cryptocurrency/bitcoin/blockchain ecosystem we have today.

At the outset, anyone can add lines to the ledger, and everyone settles up at the end of every month. If you spent more money than you received, put money into the pot; otherwise, take out what you’re owed.

However, if anyone can add a line, then how do we trust all transactions are what the sender meant them to be? One solution is to use a digital signature – and prevent signature copying by using a public/private key pair, typically 256 bits in length. However, the signature is a function not only of the secret key (SK), but also the message; tampering with the message, even slightly, changes the signature.

The private key means only the legitimate originator can produce that signature, while message dependency means no one can copy it and forge it on another message. A Verify function then compares the public key with the SK to prove the message is valid, and provides a True or False (T/F) result. The object is that it’s completely infeasible to find a valid signature without the secret key. The only way to find it is through guessing and checking, but there are 2256 combinations of 256 bits – an enormously large number. This gives very high confidence that the signature must have been generated with knowledge of the SK.

A unique message ID can be generated for every transaction, to stop the entire transaction being copied. Overspending can be prevented by having everyone put £100 into the pot initially, and then not accepting transactions that exceed anyone’s balance on the ledger. This generates a need to maintain a full history of all transactions. Additionally, the entire system could be run using cryptocurrency instead of real money; the cryptocurrency is the transaction history. Nevertheless, crypto and real currencies could be exchanged.

However, a major trust issue still exists – who hosts the central website? To solve this, everyone has their own copy of the ledger. Every transaction is broadcast for everyone to hear and record on their own private ledger. But can everyone agree on what the right ledger is? How can you be sure everyone is recording the same transactions and recognises that you have received money with which to make payments?

This calls for a protocol to accept or reject transactions, in the right order, so users can feel anyone in the world following the same protocol has a personal ledger that looks the same as theirs. This was the problem addressed in the original bitcoin paper by Satoshi Nakamoto.

One solution is to trust the ledger that has the most computational work put into it; use computational work as a basis of what to trust. Fraudulent transactions and conflicting ledgers can be made to require an infeasible amount of computation. This can be done with a hash function, which can use any type of message or file and outputs a bit string of fixed length like 256 bits:

SHA256(“3Blue1Brown”) = (256-bit binary string)

The string is a hash, or digest, of the message. Slightly change the input, and the hash changes completely. SHA256 is a cryptographic hash function, which makes it impossible to work back from the result to the function – except for guess and check, which again invokes a need for 2256 combinations. A huge number of security systems depend on this non-reversible property; SHA256 is widely used by YouTube, banks and other organisations.

A transaction is completed by someone calculating a number such that when the number plus the transaction is hashed through SHA256, it generates a hash with, say, 30 leading zeros. The only way to generate this number is to run a trial and error process, which takes significant computer time – but when completed, this provides ‘proof of work’. Everyone trusts the ledger with the most work put into it.

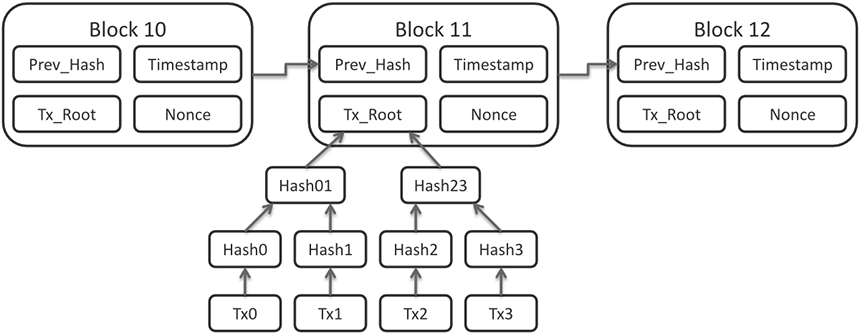

This is handled in practice by breaking a given ledger into blocks – each containing a list of transactions terminated by a proof of work number. A block must contain the hash of the previous block as its header. If you change a transaction or order of blocks, the hash becomes invalid, so blocks are chained together – creating the concept of a blockchain, rather than a ledger. Fig.2 shows a simplified bitcoin blockchain schematic.

Anyone can be a block creator, by listening to transactions, gathering them into a block, then doing the work to find the special number to make the hash start with 30 zeros. They then broadcast the block again. As a reward, they can add an extra transaction at the start of the block, in which they receive a small payment out of thin air – a ‘block reward’. Currency volume in the crypto economy increases with each new block. Creating blocks is called ‘mining’ because it involves heavy work and it introduces new bits of currency into the economy.

From a miner’s viewpoint, mining is like a race or lottery, with the first to find the number winning the award.

Users listen for blocks being broadcast by miners and update their own personal copies of the blockchain. If they hear two distinct blockchains with conflicting transaction histories, they choose the longest one with the most work put in. With a tie, they wait until one chain receives an additional block that makes it longer. This is decentralised consensus.

If one user tries to send another a fraudulent block, they will have to generate a proof of work before other miners. This may work once, but they would have to keep adding blocks ahead of other miners. If they have less than 50% of the network’s available computing power, they must eventually lose.

All the money in Bitcoin ultimately comes from some block award. The award keeps reducing as more miners enter, so there will never be more than 21 million bitcoins in existence. However, miners can also collect transaction fees. Users can add a transaction fee to a transaction, which will go to the miner that picks up the block. This incentivises miners to include the transaction into the next block they broadcast.

Although an example target value of 30 leading zeros was mentioned previously, this value periodically changes. This is to boost the difficulty of finding the proof-of-work number, maintaining the typical ‘find time’ at about 10 minutes for bitcoin. Other find times are used for other cryptocurrencies.

Fig.2: Simplified bitcoin blockchain schematic – Image via Wikimedia Commons

Obtaining cryptocurrencies – and selling them

There are two ways of obtaining cryptocurrency coins.

The first is to buy them . This requires setting up an online wallet to store the encryption keys and money, or establishing a wallet on a third-party site such as Coinbase. Paper wallets with printed QR codes are also possible, as are hardwired wallets that look something like a USB stick. Next, choose an exchange service such as Coinbase or Xapo that will let you convert between real and crypto currencies, and in some cases trade in bitcoins. Most agencies will let you both buy and sell bitcoins, as well as exchange bitcoins for cash, or for other cryptocurrencies .

It is also possible to use platforms such as LocalBitcoins which helps find local individuals willing to exchange bitcoins for cash. Additionally, some banks will accept cash deposits and deliver bitcoins a few hours later. There are also ATMs that will accept fiat (real) currency notes, scan a paper wallet’s QR code and transmit an appropriate bitcoin value to the associated account accordingly.

The other way is to mine them; this has been introduced above, and is covered in more detail below.

The realities of cryptocurrency mining

In the early days of Bitcoin, miners could make money by running the hash algorithms on their desktop PCs or sometimes a Raspberry Pi . Comprehensive details about the Raspberry Pi and its support products are available on the Premier Farnell website , as well as information about other useful single board computers . However, as more miners have joined the network, competition and performance demands have increased, generating a need for more powerful hardware. Graphics gaming cards provided the first improvements, as GPUs have large numbers of ALUs that can handle the repetitive work needed for computing the SHA256 algorithm. However, these cards had high energy consumption and became hot. Commercial mining products, with chips reprogrammed for bitcoin mining, then appeared. These were faster, but still power-hungry. FPGAs, and now possibly ASICs, offer better solutions as they can provide both speed improvements and power reduction.

Miners now have several options. Firstly, they can work together in a pool to share the load. Pools find solutions faster than their individual members, and each member is rewarded proportionally to their contribution. One such pool is NiceHash ; because they split out the load, they don’t insist on special hardware, but they do specify desktop machines, workstations or servers with powerful, discrete graphics cards. Laptop PCs, or desktops with integrated graphics are not powerful enough. ASIC machines and farms are also supported.

NiceHash works with many cryptocurrencies – Litecoin, DogeCoin, FedoraCoin, Ethereum and others, as well as Bitcoin.

Alternatively, miners can go down one of several hardware routes. They could buy a professionally built ‘ASIC’, which is actually an entire machine built around ASIC technology. One example is the Antminer S9 offered by Bitmain Partner . According to Bitmain, each Antminer S9 uses 189 chips to deliver more hash rate and efficiency than any other bitcoin miner ever made. The BM1387 chip is built using TSMC’s 16nm FinFET technology. Another approach is to buy a USB add-on such as one of the ZTEX FPGA boards for cryptographic computations including bitcoin mining.

A further possibility is to build your own machine, following instructions such as those provided by Coinminingrigs.com. This uses a single motherboard running six graphics cards such as the NVIDIA GTX 1060 6GB, GTX 1070, AMD Rx 580 or Rx 570.

Whichever hardware route miners choose, one fact remains certain. Making a profit can be difficult, because cryptocurrency values are volatile, and the profits from block awards are always being challenged by the capital costs of powerful hardware, plus the energy costs of operating it.

More information about AMD-Xilinx and its products is available on the Farnell element14 website.

The future of Bitcoin – legislation and technology

While cryptocurrency, and especially Bitcoin, have been receiving much media attention, its future remains volatile. Few people use it to buy things; Overstock.com, the largest online retailer to adopt bitcoin, says that it accounts for less than 0.1% of sales . The cryptocurrency’s main role appears to be behind the scenes, providing an open and inexpensive way for banks and other organisations to move money around.

Other commentators have much higher expectations for Bitcoin’s future though. Within a presentation at a Bitcoin 2013 Convention in San Jose, Erik Voorhees said :

“Bitcoin’s attributes enable it to operate freely and grow within an increasingly larger sphere of activity. Inevitably, this means it will start displacing monies with inferior attributes.

Bitcoin will grow like a benevolent hydra, with heads sprouting up in every country and community. It will gobble up commerce that has, until now, been shackled to the economic witchcraft of a decrepit fiat financial system, and will leave an expansive, frictionless marketplace in its wake. It is up to all of you, to capture and grow that new marketplace.”

However, some industry experts believe that increasing the blockchain’s block size is essential to accommodate the increasingly large number of transactions on the network. Otherwise, the bitcoin network could gradually slow to a crawl. The network currently performs about seven transactions per second, compared with 100 for PayPal and 4,000 for Visa. However, some players prefer to maintain the status quo to avoid scaring away investors.

Regulation, which is not yet mature and will likely change – as well as differing in different countries – also impacts the cryptocurrency. An article by Eitan Jankelewitz of the law firm Sheridans describes how in the UK, there are three areas of legislation to consider; consumer protection, prevention of money laundering, and taxation. Foreign regulations also have certain implications for those operating in the UK.

In the UK, the Financial Conduct Authority (FCA) is the regulator with responsibility for ensuring that financial services are provided in a way that protects consumers and maintains the integrity of the market. However, the FCA has not offered any constructive guidance or comment on the regulation of digital currencies. In fact, the FCA has gone as far as stating it does not regulate digital currencies and has no intention of doing so. Without any formal guidance, businesses are having to act on their own interpretation of what the rules ought to be.

The Money Laundering Regulations 2007 are enforced by a number of entities, principally the UK’s tax authority, the HMRC (HM Revenue & Customs), and the FCA, but also some others. However, there is no formal obligation to take any steps to prevent money laundering through dealings made in bitcoin. By comparison, US businesses must comply with anti-money laundering regulations at a federal level and then essentially repeat this compliance in almost every other state.

In response, most UK businesses take regulation into their own hands. They take some measure to try and identify their customers for the purposes of preventing money laundering.

For taxation, HMRC is still considering how to treat bitcoin. VAT will most likely be charged on bitcoin service charges, but not on the currency itself. Therefore, an exchange would have to charge VAT on its commission, but not on the bitcoins traded. Additionally, HMRC is considering all other aspects of taxation, not just VAT. Hopefully there will be some development in this area soon, with a definitive position on how bitcoin businesses should account for tax.

UK companies can also be affected by foreign legislation, especially in the US. There, operating a money transmission business is regulated by the Financial Crimes Enforcement Network (FinCEN) at a federal level, and then again at state level. In March 2013, FinCEN extended the scope of this regulation to bitcoin exchanges and others buying and selling bitcoin or other digital currencies.

Unfortunately for UK businesses, this regulation also applies to non-US businesses providing their services to US citizens. As a result, most UK businesses simply close their doors to US citizens until they are ready to expand into the US market and have sufficient funds to undertake the compliance process.

Beyond the UK and the US, the legal status of bitcoin varies substantially from country to country and is still undefined or changing in many of them. Although most countries do not make the usage of bitcoin itself illegal, its status as money (or a commodity) varies, with differing regulatory implications. While some countries have explicitly allowed its use and trade, others have banned or restricted it. Likewise, various government agencies, departments and courts have classified bitcoins differently. An article in Wikipedia provides a comprehensive country by country listing of bitcoin’s current legality.

Conclusions

In the brief time since their introduction, blockchain, bitcoin and other cryptocurrencies have had a profound effect on those who have chosen to work with them. Extreme volatility in cryptocurrency values have led to both losses and gains of great significance for speculators. The cryptocurrencies’ future is equally uncertain, with predictions of continued dramatic growth matched by others of their ultimate demise. However, blockchain is also a promising concept in its own right, with many applications not related to cryptocurrency already making an appearance.

References

https://bitcoin.org/bitcoin.pdf

https://www.quora.com/What-are-non-Bitcoin-applications-of-blockchain-technology

https://www.youtube.com/watch?v=bBC-nXj3Ng4

https://www.wikihow.com/Buy-Bitcoins

https://computers.tutsplus.com/tutorials/how-to-create-a-raspberry-pi-bitcoin-miner--cms-20353

/c/development-boards-evaluation-tools/embedded-single-board-computer-sbc

https://bitmain-partner.com/antminer-s9

http://www.tsmc.com/english/default.htm

https://en.bitcoin.it/wiki/ZTEX_FPGA_Boards_for_Bitcoin_Mining

https://www.wired.com/2016/02/the-schism-over-bitcoin-is-how-bitcoin-is-supposed-to-work

moneyandstate.com/role-bitcoin-money

https://www.coindesk.com/bitcoin-regulation-uk

https://en.wikipedia.org/wiki/Legality_of_bitcoin_by_country_or_territory

The concepts and realities of the cryptocurrency ecosystem. Date published: 15th March 2018 by Farnell element14